Financial-Grade Security for a Digital-First World

Advanced Security. Total Peace of Mind.

At XlentPay, security isn’t just a feature—it’s the foundation of everything we do. From cutting-edge encryption to strict regulatory compliance, we ensure your funds and data are always protected. Whether you're making transactions, managing accounts, or using our prepaid cards, your safety is our top priority.

How We Keep Your Money & Data Safe

Military-Grade Encryption & Data Protection

Your security is our priority. Every transaction and piece of user data is protected by 256-bit encryption and TLS 1.3 secure communication protocols. This ensures your sensitive financial information remains safe from cyber threats and unauthorized access — at all times.

AI-Powered Fraud Detection & Monitoring

We leverage advanced AI-driven systems to monitor transactions and flag suspicious activity in real time. Our automated fraud detection protocols operate 24/7, identifying and blocking unauthorized actions before they can impact your account.

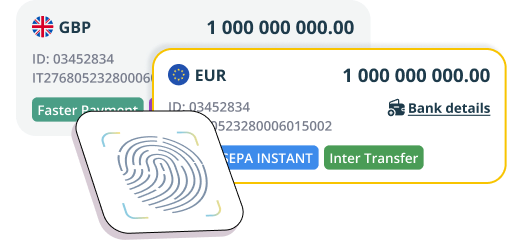

Multi-Layer Authentication & Biometric Security

Your account is protected by multiple layers of authentication, including password protection, device verification, and biometric login options like fingerprint and facial recognition. This ensures that only you can access your account — securely, and with ease.

Fraud Prevention & Infrastructure-Level Protection

Account Protection

We take every measure to ensure your account is fully secure — at all times:

- Two-Factor Authentication (2FA)

Required for logins, transactions, and sensitive account changes. - Biometric Login Support

Unlock access with Face ID or fingerprint authentication for seamless yet secure access. - Real-Time Alerts

Stay informed with instant notifications for every transaction.

Secure API & Platform Architecture

XlentPay is built on a secure, cloud-based infrastructure that’s ISO 27001 certified, offering enterprise-grade protection against evolving cyber threats:

- Secure API connections

Ensure safe and encrypted platform integrations. - Role-Based Access Control (RBAC)

Restricts internal access based on user roles, enhancing operational security. - DDoS Protection & Intelligent Firewalls

Actively defend against cyberattacks and unauthorized traffic.

How We Safeguard Your Funds

At XlentPay, security goes beyond technology. We combine robust infrastructure, regulatory compliance, and responsible fund management practices to ensure your money remains protected and accessible — whenever you need it.

FINTRAC-Registered Financial Services Provider

XlentPay operates as a registered Money Services Business (MSB) with FINTRAC in Canada. We strictly adhere to anti-money laundering (AML) and counter-terrorist financing (CTF) regulations to ensure full compliance and accountability.

Segregated Customer Accounts

Your funds are kept completely separate from our operational accounts. All customer deposits are held in segregated accounts with top-tier financial institutions, ensuring your money remains protected and fully accessible.

CDIC-Backed Protection for CAD Wallets

While XlentPay itself is not covered by CDIC insurance, the deposit-taking institution is, and eligible deposits held in trust may be protected under CDIC’s trust deposit insurance rules. This ensures an added layer of security for your funds in accordance with Canadian financial regulations.

Chargeback & Dispute Resolution Protection

We’ve got your back when things go wrong:

- Chargeback Protection

In the event of unauthorized transactions on your prepaid card, our team will support you through the process. - Dispute Resolution Assistance

We work closely with regulatory bodies to resolve financial disputes quickly and fairly.

24/7 Security Monitoring & Customer Support

Our cybersecurity team continuously monitors platform activity to detect and prevent threats in real time. If you notice anything unusual, our support team is available 24/7 to help — anytime, anywhere.

Frequently Asked Questions (FAQs)

We use AI-powered fraud detection systems that monitor transactions in real time, scanning for suspicious activity and blocking unauthorized access before it happens. Combined with multi-layer authentication and biometric login options, your account is protected from all angles.

Yes. All customer funds are held in segregated accounts with trusted financial institutions and are never mixed with XlentPay’s operational funds. We follow strict regulatory standards to ensure your money remains safe and accessible at all times.

If your prepaid card is lost or stolen, you can immediately lock it through the XlentPay app. Our chargeback protection also ensures that you’re supported in the event of unauthorized transactions. Our team is available 24/7 to help you resolve any issues.

Yes. XlentPay is a Money Services Business (MSB) registered with FINTRAC in Canada. We fully comply with all AML (anti-money laundering) and CTF (counter-terrorist financing) regulations to ensure secure and lawful financial operations.

Our platform is built on a secure, cloud-based infrastructure that is ISO 27001 certified. We implement 256-bit encryption, TLS 1.3 protocols, DDoS protection, and role-based access controls, along with 24/7 monitoring by our cybersecurity team.

Client funds held in Canadian Dollars are safeguarded in segregated accounts with a financial institution that is a member of the Canada Deposit Insurance Corporation (CDIC). While XlentPay itself is not covered by CDIC insurance, the deposit-taking institution is, and eligible deposits held in trust may be protected under CDIC’s trust deposit insurance rules. This ensures an added layer of security for your funds in accordance with Canadian financial regulations. For more details on how CDIC protection works and what is covered, you can refer to our summary document.

Your Trust, Our Commitment

XlentPay combines financial-grade security with advanced technology to keep your money and data safe — every step of the way.

Fully Regulated

Operating as a FINTRAC-registered Money Services Business (MSB) in full compliance with Canadian financial regulations.

AI-Powered Fraud Detection

Intelligent systems monitor activity 24/7, blocking threats before they impact your account.

Secure Fund Segregation

Customer funds are held in segregated accounts with trusted financial institutions.

Advanced Protection

Every transaction is secured with 256-bit encryption and multi-factor authentication.

Ready for a digital finance experience that puts security first?

Open Your Secure Account Today